Cracks in the financial system? Pricing the damage for equity portfolios

BlackRock Contributors:

Andrew Ang

Head of Factors,

Sustainable and Solutions,

BlackRock

Rob Powell

Head of Thematic and

Sector Product Strategy,

BlackRock

Laura Cooper

Senior Investment

Strategist for EII EMEA,

BlackRock

Could the latest bout of turbulence have the potential to create new growth opportunities? What approaches should investors consider taking to help their portfolios withstand stock market volatility? These were just two of the questions addressed by the latest edition of The Point, the online event series run by BlackRock, which took place against the backdrop of the banking-sector crisis that rocked global markets in March. Moderator and BlackRock senior investment strategist Laura Cooper introduced the event by noting that the changes in monetary policy since the start of 2022 had “exposed cracks in the financial system”. She added: “While the tightening in financial conditions stemming from recent market stress does do some of the heavy lifting of policy makers, pointing to lower policy rate peaks than we had previously expected, there does remain the potential for a still higher-for-longer interest rate backdrop, given the persistence of elevated inflation. Against that backdrop, it is prudent to position portfolios to consider this regime shift.”

“A rapid shift to a new rates regime has exposed cracks in the financial system, most notably in the U.S. and European bank tumults. This has raised questions certainly among investors about how to position portfolios in this period of heightened uncertainty. “

Laura Cooper, BlackRock senior investment strategist

A focus on quality

Andrew Ang, Head of Factors, Sustainable and Solutions at BlackRock, set out the strategies investors could consider to help their portfolios navigate the ongoing uncertainty in the banking sector and wider equity markets. “In this era of pronounced volatility, you look for high quality names,” he explained. “We want companies that have low leverage and which are not so exposed to the financial tumult. We also would like companies with steady cashflows or low earnings variability.” A third positive element, Ang said, was businesses’ ability to use capital efficiently, given its increasing scarcity. “We favour companies that are capable of delivering a high return on equity.”

Ang pointed out that 2022 had been a particularly challenging year for quality investment strategies for two specific reasons. “Usually when equity and bond valuations are falling, you would expect quality to outperform,” he said. “But that wasn’t the case last year, primarily because of high inflation and ongoing supply chain issues. Because they have more steady cash flows, quality strategies are more exposed to the rises in interest rates that were used by central banks to control inflation. And quality companies, because they are more efficient, tend to make greater use of global supply chains, which were heavily disrupted by the pandemic.” The picture in 2023 has improved, Ang added: “Now we are past peak inflation, I think. Interest rates are still on the rise, but inflation is no longer the primary concern. Meanwhile, we have seen companies reshore some of their supply lines, and high-quality companies have found other ways to be more efficient.”

Ang also discussed BlackRock’s approach to portfolio construction, explaining how he and his team balance a variety of factors depending on external circumstances – a topic Ang explored in greater detail in a recent Andrew’s Angle report. “We have a framework that looks at four categories, the most important of which is the economic cycle,” he said. “As well as the cycles of the underlying fundamental economy, we also have cycles of market sentiment, equity market returns and interest-rate volatility, which is very relevant today.

“Secondly, we look at how rich or cheap these different factors are. We also have different sentiment type measures, such as past risk-adjusted return, and finally some factor-specific dynamics. These allow us to play different pairs like value and growth or small versus large.” In terms of Ang’s current approach to portfolio construction, the most overweight position BlackRock has in both its US and European portfolios is quality. “This is primarily because of the late-cycle regime we find ourselves in,” he added. “There is more information in an article, Factors For All Weathers, and in an article published in the Journal of Portfolio Management.”

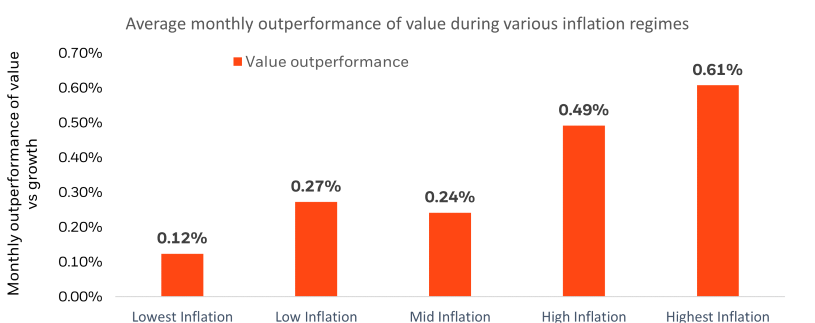

Dealing with long-term inflation

With the possibility that currently high levels of inflation could persist in the medium to long term, Ang said there were several factors that could result in inflation remaining elevated, despite central bankers’ best efforts. These include the cost of dealing with the damage caused by climate change and extreme weather and a rolling back of some of the gains associated with globalisation, as well as the impact of an aging global population and the consequent decline in savings rates. Ang says: “One underappreciated strategy to hedge inflation is value. Value is a short duration strategy; they pay cash flows today. During times of high inflation we like these short duration assets. I think inflation is going to be persistent because of the new regime that we’re in today. I think that investors might consider value as a inflation pitching strategy in their portfolios.”

Value – A history of outperformance in inflationary regimes

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Performance does not reflect any management fees, transaction costs or expenses.

Source: BlackRock with data from Kenneth R. French Data Library and Robert J. Shiller, Data from 7/1926 to 08/2022. http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Fama and French data uses the CRSP universe which includes all companies incorporated in the U.S. and listed on the NYSE, AMEX or NASDAQ exchanges. Inflation determined by using YoY changes in CPI and breaking into quintiles. “Value outperformance” represents performance of value stocks minus growth stocks as defined by the Fama and French HML research factor (high book to price minus low book to price). For illustrative purposes. only.

Portfolio resilience

Rob Powell, BlackRock’s Head of Thematic and Sector Product Strategy, explained that thematic investment strategies could help increase portfolio resilience in three key areas, as he initially set out in his thematics outlook paper at the start of 2023. “The first is macro resilience, specifically investments that could benefit from a prolonged period of inflation,” he said. “For example, agribusiness has been one of the top asset gatherers over the last few years because many upstream agricultural companies are able to pass on cost increases to their customers.” Climate resilience is another key area and one that has received additional emphasis as a result of the energy-market implications of the Russia/Ukraine conflict. “Supply chain resilience is the third strategy worth exploring,” Powell added. “For example, automation is an area that could benefit from moves towards the reshoring of supply chains, or deglobalisation in general.”

“We’ve seen an increase in demand for combinations of themes within portfolios rather than exposure to single themes based on a particularly high conviction view. And this is because our clients want exposure to the thematic premium -- the disruption across the cycle. “

Rob Powell BlackRock’s Head of Thematic and Sector Product Strategy

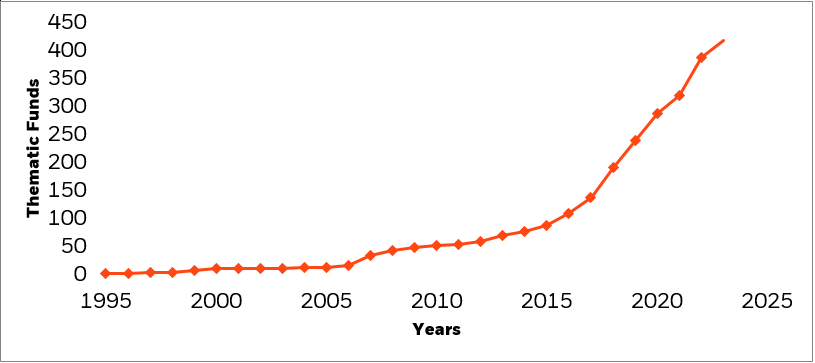

Powell talked about the rise of thematic investing as well as its potential to deliver growth opportunities despite wider market turbulence. “We’ve seen assets under management in thematic funds grow by six times since 2016, from $42 billion to around $260 billion as at end February 2023,” (Source: Morningstar as at 28/02/2023) he said. “The most common misconception when it comes to thematic investment is that all of the products within this space are focused on technology. But there has been a clear rotation towards climate-related themes in particular over the last 12 to 18 months. And in fact around 60 percent of the total flows to the thematic fund industry since the start of 2021 have gone to those climate related strategies.” (Source: Morningstar as at 28/02/2023. Figures based on proprietary thematic universe that only includes pure thematic funds. All currency figures in USD.)

The development of thematic funds - Cumulative number of thematic funds launched

As at end February 2023, there were over 418 funds in the market, across more than 16 different structural growth themes

Data: Morningstar and BlackRock, as at 28/02/23

Driving disruption - The future of thematic investing

Powell added that BlackRock had recently set up its own think tank, the Thematic Research Investment Group, to drive its views on the major themes that are likely to emerge in the short to medium term and drive future portfolio construction. “A key theme that is emerging right now is the focus on transition,” he explained. “This means concentrating not on companies which already have strong sustainability characteristics, but on those businesses that are on the path to net zero. A particular area where we see a potential sweet spot is within the material space, where companies could experience a structural increase in demand for their end product.” Powell pointed out that global demand for copper for solar panels, lithium for electric vehicle batteries and aluminium for wind turbines, for example, is likely to surge in the next few years. “However, producers of these materials also happen to be some of the highest emitting companies in the world. So there is a significant opportunity here: materials firms that are on an accelerated path to net zero compared to their peers will be rewarded by the market on sustainability grounds, while also seeing a rapid rise in demand.”

The Point event series gets straight to it, with the latest insights from BlackRock.

Related content

| Factors for all weathers | Thematics Outlook 2023 | 2023 Q2 Global Outlook |

|---|---|---|

| Factors can play a role in more selective and nimble portfolios – but we think allocating based solely on the business cycle won’t work in the new regime Read more |

Explore three key themes that we believe are going to drive markets in 2023 and their implication for Thematics Investing. Read more |

Read the latest views from the BlackRock Investment Institute across asset classes, as we take stock of recent events and their potential implications for tactical and strategic allocations Read more |

This document is marketing material: Before investing please read the Prospectus and the PRIIPs KID available on www.blackrock.com/it, which contain a summary of investors’ rights.

Risk Warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is issued by BlackRock (Netherlands) B.V., authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

In Italy: For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

For investors in Bahrain

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Dubai (DIFC)

BlackRock Advisors (UK) Limited - Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit L15 - 01A, ICD Brookfield Place, Dubai International Financial Centre, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738).

The information contained in this document is intended strictly for Professional Clients as defined under the Dubai Financial Services Authority (“DFSA”) Conduct of Business (COB) Rules.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Israel

BlackRock Investment Management (UK) Limited is not licensed under Israel's Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder.

For investors in Kuwait

The information contained in this document is intended strictly for sophisticated institutions that are ‘Professional Clients’ as defined under the Kuwait Capital Markets Law and its Executive Bylaws.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Oman

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in Qatar

The information contained in this document is intended strictly for sophisticated institutions.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public.

The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

For investors in South Africa

Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the

South African Financial Services Conduct Authority, FSP No. 43288.

For investors in Switzerland

This document is marketing material. This document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.

For investors in United Arab Emirates

The information contained in this document is intended strictly for non-natural Qualified Investors as defined in the UAE Securities and Commodities Authority’s Board Decision No. 3/R.M of 2017 concerning Promoting and Introducing Regulations.

The information contained in this document, does not constitute and should not be construed as an offer of, invitation or proposal to make an offer for, recommendation to apply for or an opinion or guidance on a financial product, service and/or strategy. Whilst great care has been taken to ensure that the information contained in this document is accurate, no responsibility can be accepted for any errors, mistakes or omissions or for any action taken in reliance thereon. You may only reproduce, circulate and use this document (or any part of it) with the consent of BlackRock.

The information contained in this document is for information purposes only. It is not intended for and should not be distributed to, or relied upon by, members of the public. The information contained in this document, may contain statements that are not purely historical in nature but are “forward-looking statements”. These include, amongst other things, projections, forecasts or estimates of income. These forward-looking statements are based upon certain assumptions, some of which are described in other relevant documents or materials. If you do not understand the contents of this document, you should consult an authorised financial adviser.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2023 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS and iSHARES are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

MKTGH0423E/S-2840736